Understanding Supplemental Health Coverage

When injuries or hospital visits happen, this helps cover deductibles, out-of-pocket costs, and gaps health insurance doesn't.

Why Health Insurance Still Leaves Families Paying

Health insurance helps cover medical care — but it doesn't cover everything. Most plans use a shared cost structure, meaning families still pay through deductibles, copays, and coinsurance even when fully insured.

That's why illness or injury can still create unexpected out-of-pocket costs during recovery. This isn't a failure of insurance — it's how most plans are designed to work.

The Importance of Supplemental Coverage

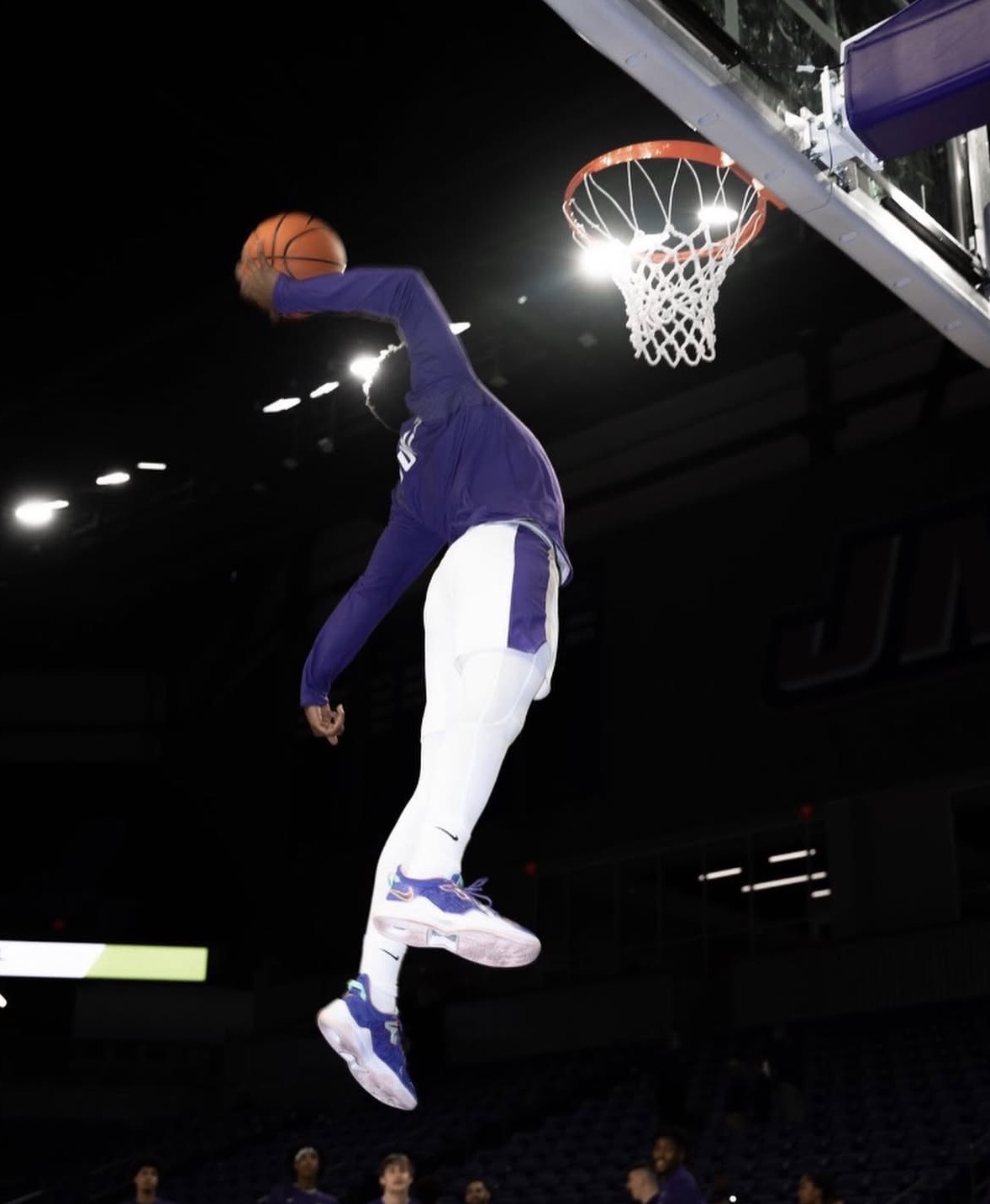

As a former Division I athlete, I've been through two ACL surgeries and a serious groin injury that required surgery. Most athletes think they're covered — until they're injured and realize what insurance doesn't pay for. That experience taught me something most families don't realize until it happens — injuries don't just affect athletes physically and mentally, they often create real financial pressure for the entire family too. That's why NIL Wealth focuses on simple, affordable supplemental protection that supports families when real-life costs show up.

What Is Supplemental Health Coverage?

Supplemental health coverage helps families handle out-of-pocket and everyday costs that can remain after regular health insurance pays its portion. It works alongside existing coverage by paying direct cash benefits for covered injuries, accidents, or hospital stays. Benefits are paid in addition to school or medical coverage, at the full amounts outlined in the policy, and are not based on the size of the medical bill. Because it's benefit-based (not reimbursement-based), you may still receive the payout even if bills are fully covered — and use the money however you need (deductibles, travel, rehab, rent, lost wages, etc.). Coverage isn't limited to one use. Benefits may be paid multiple times for qualifying events as long as the policy remains active.

For Coaches & Trainers

Coaches and trainers often see injuries first — especially during offseason workouts, camps, tournaments, and private training where school coverage may not apply.

This page is provided as an optional educational resource that coaches may choose to share with families.

- Coaches do not sell, explain, or enroll insurance

- Coaches do not handle money or paperwork

- Families review coverage and enroll directly with Aflac

- NIL Wealth Strategies provides education and support only

Sharing this resource is completely optional and carries no obligation for coaches or families.

Copy this and share with your team families:

"Here's a resource on supplemental coverage families can review: https://mynilwealthstrategies.com"

Thank you for supporting your athletes beyond the field.

Coaches are not endorsing specific coverage and are not involved in enrollment decisions.

Coaches and trainers are not affiliated with NIL Wealth Strategies and do not provide insurance advice.

Next Step: View Coverage Options

Request access to review official coverage details.

No payment required to review options

Coverage options are offered through nationally recognized supplemental health insurance carriers, including Aflac, with enrollment, pricing, underwriting, and claims handled directly by the carrier. Coverage is subject to policy terms, exclusions, and limitations, and this information is provided for educational purposes only and does not replace the policy contract.

Download the Supplemental Health Guide

A clear, easy-to-follow overview explaining how supplemental health coverage works, how cash benefits are paid, and what to expect during the claims process — designed for athletes and parents.

View Supplemental Health Guide